All About Asset Allocation

Don’t put all your eggs in one basket. We are sure you would have heard this saying multiple times. This is also one of the basic philosophies of personal finance. What it means is that when investing, you shouldn’t invest all your money in one asset class. But why is that and how should you decide where to allocate your money and how much? In this discussion we will talk about the principles of asset allocation, why it’s important, how you should decide what asset allocation works for you and why rebalancing is an extremely important component.

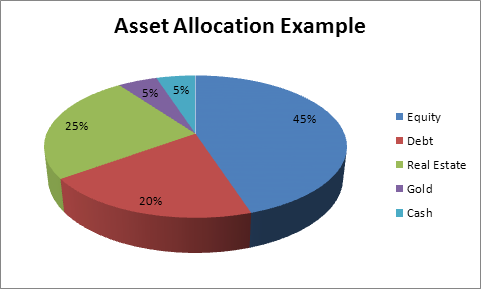

When you invest in one investment option or asset class, the risk you are taking is extremely high. So, to reduce the risk you need to diversify your investments by investing your money in different investment options and asset classes like real estate, gold, mutual funds, equities, and fixed deposits. This is what asset allocation is all about. Asset allocation helps investors reduce risk through diversification. Historically, the returns of stocks, bonds, and cash haven’t moved in unison. In other words, asset allocation matters a lot more than stock picking when it comes to reaching your financial goals.

Example:

To understand the importance of spreading out your investments across asset classes, let’s take the example of one asset class, real estate.

The real estate sector noticed a boom between the years 2010 and 2013, and people were being lured with expectations of 10-20% returns in a short period. But had you invested during that period, your returns today would have been in the range of -20%. That’s because the home rates have fallen by that much percentage in the last 6-7 years. In some cases, people even lost their entire money because some developers went bankrupt.

This example implies that no one in this world can predict which asset class or investment option will do well in the future and which won’t. Hence to mitigate the risk, you must diversify your portfolio and invest your funds in different asset classes.

How to decide your asset allocation:

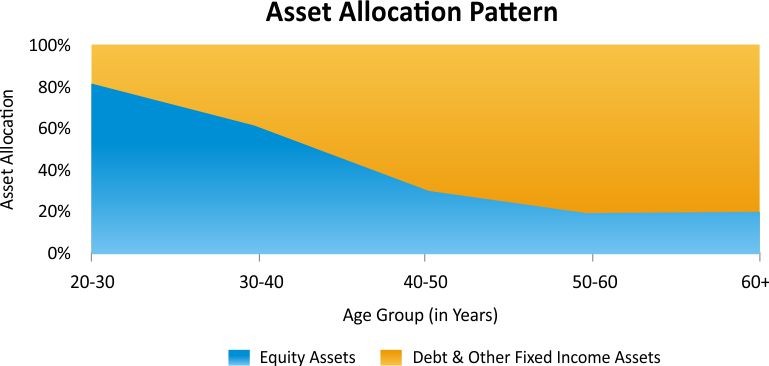

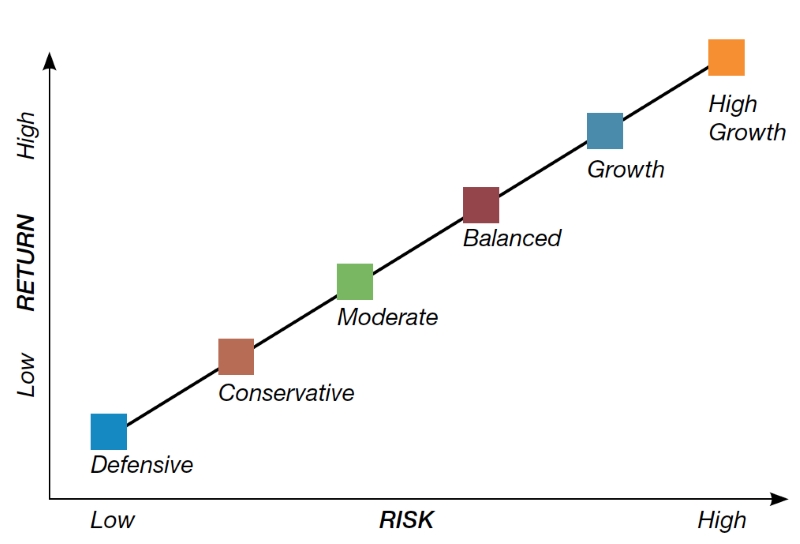

So how should you decide your asset allocation? Well, one of the most important factors is your risk profile. Every individual’s risk profile is different and owing to this, the standard rule of asset allocation shouldn’t be used.

Understanding your risk profile :

To understand your risk profile you need to understand three components that constitute your risk profile – risk appetite, risk capacity, and risk tolerance. You might think of these terms as the same, but you must note that there is a difference between each of these.

1.Risk appetite is how much risk you are willing to take 2.Risk Capacity is how much risk you can take. Although you might be willing to take the risk on your entire capital your current financial situation including liabilities, dependents, age, and salary might not allow you to do that. So you need to consider these before defining your risk capacity 3.Risk Tolerance is how much risk you can tolerate, psychologically, and mentally. For example, if you invest in stock markets, where there are a lot of fluctuations, you must be mentally prepared to tolerate the risk.

Of these three components, risk tolerance is the most critical while determining your asset allocations. That’s because you might have a high-risk appetite and risk capacity but your risk tolerance will determine which asset class and investment options you will pick. Let’s take an example. Suppose you are very hungry and feel you should eat a lot or you can eat a lot. But if you eat more than your capacity, your body won’t be able to tolerate it. So you need to have a balance. As you allocate assets on the basis of risk tolerance, you must consider personal factors like your monthly income, expenses, age, financial liabilities, your dependents in the family, etc.

However, along with this, certain macroeconomic factors also play a vital role in how your funds may perform and may change your risk profile. Additionally, asset allocation must also depend on your short-term and long-term financial goals. As the macroeconomic factors fluctuate, you may change the proportion of allocation of your funds to various asset classes. For example, if you invest in fixed deposits currently, and you receive an interest rate of 5%-6%. Now, you should figure out that with lesser interest on your investments in FDs, your risk profile would change and hence, you should change your asset allocation by shifting your funds from one asset class to the other such that you can meet your financial goals in time.

I am happy I have equity in my portfolio- it’s up.

I am not so happy with bonds – Rates up

I am not happy with gold – price down due to custom tax cut.

I am happy overall – Asset Allocation.