Smart Way to Buy or Invest in Gold

Gold is a unique asset: highly liquid, yet scarce; it’s a luxury good as much as an investments Gold is no one’s liability and carries no counterparty risk. As such, it can play a fundamental role in an investment portfolio.

Gold acts as a diversifier and a vehicle to mitigate losses in times of market stress. It can serve as a hedge against inflation and currency risk.

The combination of these factors means that adding gold to a portfolio can enhance risk-adjusted returns.

But how much gold should investors add to achieve the maximum benefit? Portfolio allocation analysis indicates that investors who hold between 2% to 10% of their portfolio in gold can significantly improve performance.

Indians’ love for Gold jewellery is inevitable. But most investment managers argue that buying gold in form of jewellery should not be mistaken as investment. They say the costs such as the making charges which can go upto as high as 25% of the price and GST, are irrecoverable on resale.

Gold Exchange Traded Funds (ETFs) and Sovereign Gold Bond (SGB) , issued by the Government of India are the smart ways to invest in gold.

Gold Exchange Traded Funds

Gold ETFs are listed on the exchanges and invest in physical gold. Each unit of a Gold ETF represents 1/2 gram of 24 karat physical gold. Gold ETFs provide ample liquidity as these can be sold on exchanges anytime.

“Investors in Gold ETFs do not bear any making charges or premium. Also, they don’t have to worry about purity, storage and insurance of gold. Moreover, Gold ETFs are traded on the exchange at the prevailing market price of physical gold, thus investors can buy or sell holdings at close to the market price, without paying a premium on purchase or selling at a discount.

Sovereign Gold Bond

SGBs are government securities denominated in grams of gold. The Bond is issued by Reserve Bank on behalf of the GOI.. The Bonds are issued in denominations of one gram of gold. An individual can invest maximum for up to 4 kg of gold through SGBs, in a fiscal year. The Bonds bear fixed interest at the rate of 2.50 % per annum , payable semi-annually. SGBs assure market price of gold at the time of selling.

SGBs come with a tenor of 8 years. It allows early redemption only after the fifth year from the date of issue. The bond is tradable on exchanges, if held in Demat form. But low trade volumes can be a hindrance. It can also be transferred to any other eligible investor.

How are Gold ETFs and SGBs taxed?

Capital gains on goold ETFs are taxed at 20% after indexation if held for over three years.

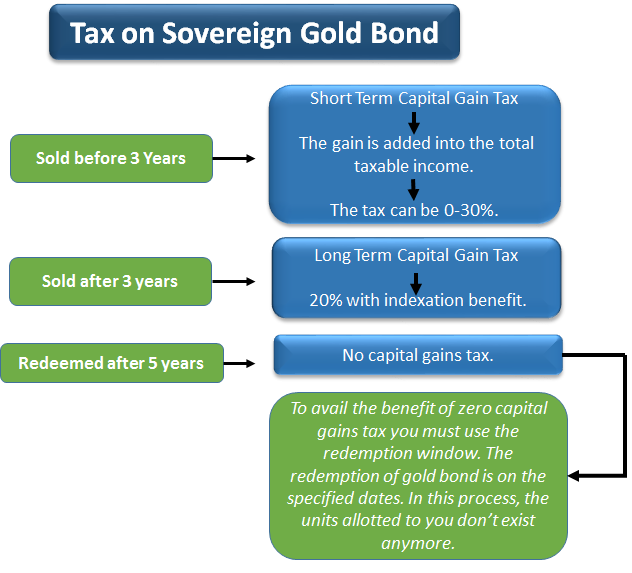

Interest on the SGBs will be taxable. The capital gains tax arising on redemption of SGB to an individual has been exempted. The indexation benefits will be provided to long terms capital gains arising to any person on transfer of bond.